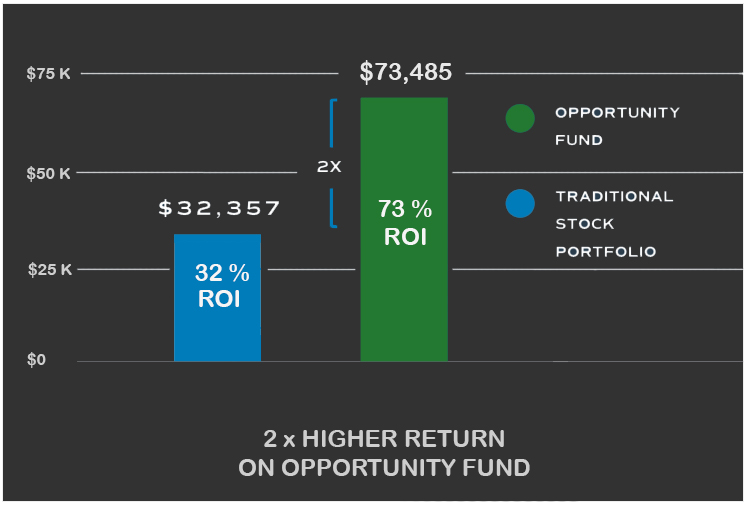

Portfolio Comparison

Traditional Stock Portfolio Versus Investment in the Opportunity Fund

Here is what an investor gets after investing $100,000 for 10 years in each option, assuming an annual appreciation of 7%:

- In a traditional stock portfolio, the investor earns a profit of $32,375 after tax

- In an Opportunity Fund, the investor earns a profit of $73,485 after tax

The chart above shows a sample investment with a YoY return of 7% and the major difference in after-tax profit for an investment of $100,000 invested in traditional stock versus the same investment with the same 7% year over year appreciation. The figures in the chart assume a rate

of 23.8% in long term capital gains, which include federal capital gains tax of 20% and a net investment income tax of 3.8%. The chart also assumes that the funds have been held in each type of investment for a period of ten years. The assumptions in the chart above are for

illustrative purposes only and should not be construed to reflect the actual results of an individual investor.