1031 Exchange Comparison

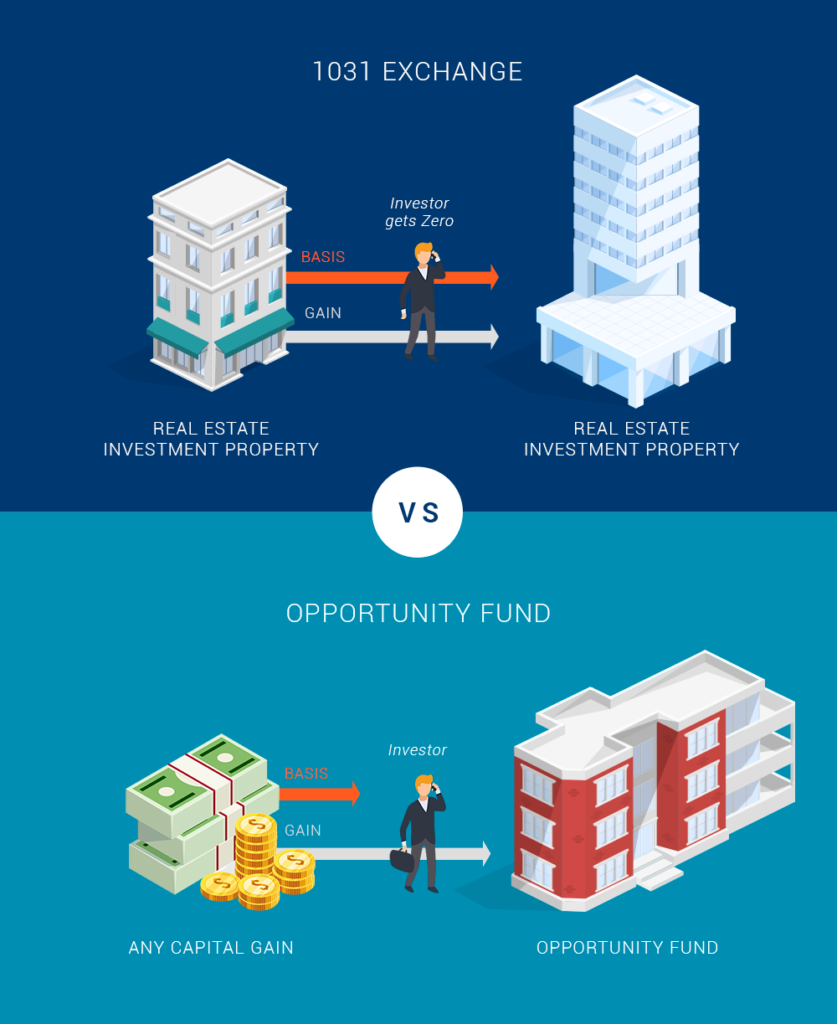

1031 Exchanges versus Opportunity Zone Fund Investment

- Most 1031 Exchanges work through third-party intermediaries who charge users for the exchange. On the other hand, investing in a Qualified Opportunity Fund does not involve any intermediary and doesn’t charge any fees.

- While 1031 Exchanges require investors to roll the principal and gains earned into the exchange, a Qualified Opportunity Fund only requires you to roll into the fund your capital gain but not the principal.

- While only real estate investments qualify for 1031 Exchange, in an Opportunity Fund, Qualified Opportunity Funds can include any capital gains from the sale of real estate and other investments including capital from the sale of stocks and crypto-currency.

- Qualified Opportunity Funds have a better investment structure. This is because 1031 exchanges are single asset swap investments. They may support multiple properties but this type of arrangement normally comes with additional costs and fees. Qualified Opportunity Funds, on the other hand, support pooled funds from multiple assets.

- Deferred Capital Gains tax. With 1031’s you don’t get capital gains reduction unless it is via a step-up basis in the event of death. When you roll from one 1031 to another, you’ll only be delaying taxation to a later date without any reduction. Most investors roll one 1031 to another in the hope that at some time in future the taxed amount will be lower than at the time of the original gain. Qualified Opportunity Funds, on the other hand, give investors a tax reduction of 10% after holding their investments in the Fund for 5 years and another 5% reduction after 7 years. It is possible to get a 15% tax reduction if you invest by December 31, 2019.

- The difference on Capital Gains tax after the final sale. As an investor in 1031 Exchanges, you will pay capital gains tax after the final sale of the asset. However, as an investor in an Opportunity Fund, you have a permanent exclusion for gains made on the original qualifying investment if you hold the investment in the Opportunity Fund for at least 10 years. This means that even if the investor realized a significant capital gain after selling his or her Opportunity Fund investment, they’ll not owe the Federal taxes any tax from the capital gain. You also don’t have a specific limit to how long you can hold your funds in the Opportunity Fund, which means you can continue building decades of appreciation from your capital gains over the years and still not owe any taxes from your investment when you sell it off 10 or more years later.

Contact us today to learn more about investing in an Opportunity Zone Fund.